Prem Chopra Hospitalized Lilavati Hospital; 90 Year Old Actor Health Update PHOTOS | પીઢ એક્ટર પ્રેમ ચોપરા હૉસ્પિટલમાં દાખલ: ઉંમર સંબંધિત બીમારીના લીધે 90 વર્ષીય એક્ટરને લીલાવતી હૉસ્પિટલમાં ખસેડાયા

2 કલાક પેહલા

- કૉપી લિંક

પીઢ એક્ટર પ્રેમ ચોપરાને મુંબઈની લીલાવતી હૉસ્પિટલમાં દાખલ કરવામાં આવ્યા છે. 90 વર્ષીય એક્ટર ઉંમર સંબંધિત બીમારીથી પીડિતા હોવાનું જાણવા મળ્યું છે. તેમને 8 નવેમ્બરના રોજ હૉસ્પિટલ ખસેડવામાં આવ્યા હતા. જોકે, હાલમાં તેઓ સારવાર હેઠળ છે અને તેમના સ્વાસ્થ્યમાં સુધારો થઈ રહ્યો હોવાનું પરિવારના સભ્યોએ જણાવ્યું છે.

કાર્ડિયોલોજિસ્ટની દેખરેખ હેઠળ હૉસ્પિટલમાં દાખલ કરાયા

ડૉ. જલીલ પાર્કરે નિવેદનમાં જણાવ્યું કે, ‘પ્રેમ ચોપરાજીને બે દિવસ પહેલા તેમના ફેમિલી કાર્ડિયોલોજિસ્ટ ડૉ. નીતિન ગોખલેની દેખરેખ હેઠળ લીલાવતી હૉસ્પિટલમાં દાખલ કરવામાં આવ્યા હતા. તેમને હૃદયની સમસ્યા પણ છે અને તેમને વાયરલ ચેપ, ફેફસામાં ચેપ પણ લાગ્યો છે, હું પણ તેમની સારવાર કરી રહેલી ટીમમાં સામેલ છું. તેઓ ICUમાં નથી, તેઓ વોર્ડમાં રૂમમાં છે અને તેમની તબીયત ગંભીર નથી.’

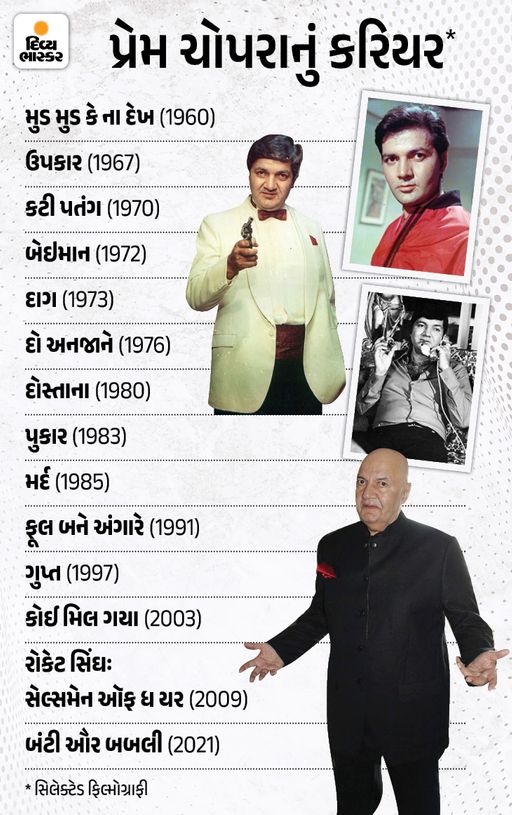

પ્રેમ ચોપરાએ ફિલ્મોમાં વિલન બનીને બોલિવૂડમાં પોતાનું અલગ સ્થાન બનાવ્યું છે.

‘ઉંમર સંબંધિત બીમારીના કારણે દાખલ કરાયા છે’

‘ઇન્ડિયા ટૂડે’ સાથેની વાતચીતમાં પ્રેમ ચોપરાના જમાઈ અને એક્ટર વિકાસ ભલ્લાએ પીઢ એક્ટરને સાવચેતીના પગલાં રૂપે હૉસ્પિટલમાં દાખલ કર્યા હોવાની પુષ્ટી કરી છે અને જણાવ્યું હતું કે, તેમની તબિયત સારી છે અને થોડા દિવસોમાં તેમને રજા આપવામાં આવશે.

તેમણે કહ્યું, ‘આ બધું ઉંમર સંબંધિત છે અને એક નિયમિત પ્રક્રિયા છે. ચિંતા કરવાની કોઈ વાત નથી.’

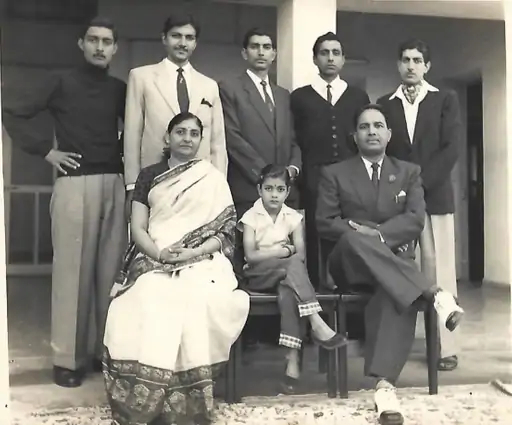

1935માં લાહોરમાં જન્મ થયો હતો

પ્રેમ ચોપરાનો જન્મ 23 સપ્ટેમ્બર 1935ના રોજ લાહોરમાં પંજાબી હિન્દુ પરિવારમાં થયો હતો. તેમના પિતા રણબીરલાલ સરકારી કર્મચારી હતા અને માતા રૂપરાણી હોમમેકર હતાં. પ્રેમ ચોપરા છ ભાઈ-બહેનોમાં ત્રીજા નંબરે હતા. ભારત-પાકિસ્તાનના ભાગલા બાદ ચોપરા પરિવાર શિમલા આવીને વસ્યો. પ્રેમ ચોપરાએ શિમલાની S.D. સિનિયર સેકન્ડરી સ્કૂલમાં અભ્યાસ કર્યો હતો.

પ્રેમ ચોપરા માતા-પિતા અને ભાઈ-બહેન સાથે.

ડેબ્યૂ ફિલ્મ સુપર ફ્લોપ રહી હતી

1960માં પ્રેમ ચોપરાએ બોલિવૂડ ફિલ્મ ‘મુડ મુડ કે ના દેખ’થી ડેબ્યૂ કર્યું હતું. જોકે આ ફિલ્મ સુપર ફ્લોપ રહી હતી. પ્રેમ ચોપરા ફરી પાછા પ્રોડ્યુસર્સની ઓફિસના ધક્કા ખાવા લાગ્યા હતા. આ જ રીતે એક દિવસ પ્રેમ ચોપરા ટ્રેનમાં જતા હતા અને એક અજાણી વ્યક્તિએ તેમને પૂછ્યું કે તે ફિલ્મમાં કામ કરવા તૈયાર છે? પ્રેમ ચોપરાએ તરત જ હા પાડી અને તે અજાણી વ્યક્તિ તેમને લઈને રણજિત સ્ટુડિયોમાં આવી. અહીં પ્રોડ્યુસર જગજિત સેઠીએ પ્રેમ ચોપરાને ફિલ્મ ‘ચૌધરી કરનેલ સિંહ’ માટે હીરોની ઑફર કરી. આ ફિલ્મ માટે પ્રેમ ચોપરાને અઢી હજાર રૂપિયા મળ્યા હતા. આ ફિલ્મને પૂરી થતાં ત્રણ વર્ષ જેટલો સમય લાગ્યો. ફિલ્મ સુપરડુપર હિટ રહી હતી અને ફિલ્મને ‘બેસ્ટ ફિલ્મ’ તથા ‘બેસ્ટ એક્ટ્રેસ’નો નેશનલ અવૉર્ડ મળ્યો.

હીરો બનવાના સપનાથી બોલિવૂડના આઇકોનિક વિલન સુધીની સફર

પ્રેમ ચોપરાએ પંજાબી અને નાની હિન્દી ફિલ્મોમાં રોલ કર્યા બાદ, 1964ની ‘વો કૌન થી’માં વિલનનો રોલ સ્વીકાર્યો. આ ફિલ્મની સુપરહિટ સફળતાએ તેમને વિલન તરીકે સ્થાપિત કર્યા. દિગ્ગજ ફિલ્મમેકર મહેબૂબ ખાને તેમને લીડ રોલ આપવાનું વચન આપ્યું હતું, પરંતુ ‘વો કૌન થી’માં તેમનો અભિનય જોઈને મહેબૂબ ખાને તેમને ધમકાવીને વિલન તરીકે જ કારકિર્દી આગળ વધારવાની સલાહ આપી. શરૂઆતમાં પાર્ટ-ટાઇમ એક્ટિંગ કરતા પ્રેમ ચોપરાને 1967માં ‘ઉપકાર’ ફિલ્મમાં વિલનના રોલ બાદ અઢળક ઑફર્સ મળવા લાગી. પરિણામે તેમણે આખરે પોતાની અંગ્રેજી ન્યૂઝપેપરની નોકરી છોડી દીધી અને કાયમ માટે બોલિવૂડના સૌથી સફળ વિલન તરીકેની કારકિર્દી અપનાવી લીધી.

/newsnation-english/media/post_attachments/78cc48e9-167.jpg)

/newsnation-english/media/post_attachments/068c7ed4-f90.gif)